Like Nvidia? Then you’ll love this under-the-radar AI stock.

i love Nvidia stock. Who wouldn’t? Over the past year, the stock has increased in value by more than 160%. Most of this growth can be attributed to the rapid increase in demand for AI components. As the industry leader in graphics processing units (GPUs) — a critical component of most AI infrastructures — the company has seen demand skyrocket in recent years.

But Nvidia isn’t the only company benefiting from the rise of AI. There is a significantly smaller business that is poised to benefit as well, even if the market hasn’t caught on yet.

Bet on AI with this under-the-radar stock

Everyone is talking about AI these days. The fervor has sent the valuations of most AI businesses soaring. However, some companies have not seen their market caps grow as much as others. One relatively small AI business in particular has fallen under the radar. There are risks to investing in this business, but also massive growth potential.

The company in question is none other than SoundHound AI (SOUND 0.10%). I wrote about this AI business a few months ago. Since then, the stock has appreciated in value by more than 20%. But the latest valuation boost could prove to be just the beginning.

As the name suggests, SoundHound AI focuses on sound-related AI applications. This will be one of the biggest ways that everyday consumers engage with AI technologies. Whether you’re wondering what song is currently playing on your phone or chatting with a customer service agent who’s actually a robot in disguise, the revolution has already begun. But interacting with artificial intelligence using voice is still in its early stages. In a few years, we may be discussing all sorts of things with the help of an AI agent.

SoundHound, for example, has already implemented its technology at a handful of automaker brands, including Kia, Hyundaiand Jeep that allows drivers to discuss maintenance issues and other mechanical questions directly with the vehicle. SoundHound has also partnered with restaurants, including Applebee’s and White Castle, to increase efficiency and reduce costs at drive-thru windows through the use of AI voice agents.

In total, SoundHound has more than 200 patents related to its AI technology, covering everything from speech recognition to natural language processing. Management believes the company has “the most advanced independent voice AI platform on the market” — a market it believes is worth at least $140 billion in total. With a market cap under $2 billion, SoundHound stock looks like a great way to add massive growth potential to your portfolio.

But there are some risks that investors need to be aware of before taking the plunge.

Understand these 2 things before investing in SoundHound

If SoundHound can capitalize on its growing customer list and demonstrate its technologies across a variety of sectors and use cases, it will have a strong position in a market that should grow tremendously over the next decade or more. In this scenario, the company will likely be worth much more than its current $1.7 billion valuation. But there are two risks that could derail this thesis.

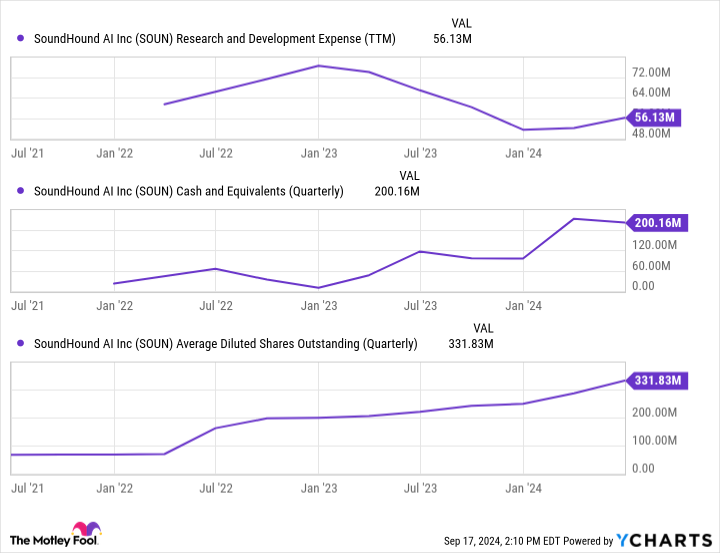

SOUN Research and Development Expenditure (TTM) data by YCharts.

First, SoundHound has limited funding. It currently has just $200 million in cash and cash equivalents on its balance sheet. That compares to just $42 million in total debt, but the problem is that SoundHound still loses money every quarter. In the last quarter alone it posted a loss of about $40 million — its biggest loss in years. To cover the gap, the company has been steadily diluting shareholders, which it will need to do if it plans to remain solvent in the short term.

Limited funding leads to SoundHound’s second challenge: a limited ability to accelerate research and development. Dozens of companies are investing heavily in their own voice AI technologies, including most of the big tech giants. SoundHound’s relatively small annual R&D spending of $56 million — a DOWN from previous quarters — will likely hinder its ability to compete in the long run. For SoundHound to win in this increasingly competitive space, it needs to find a way to greatly expand its access to capital and thus increase R&D spending. Even if it is successful in this, it will likely be at the cost of dilution to existing shareholders.

Is there huge potential for SoundHound? Absolute. And investors looking for maximum growth potential should consider this stock over larger, more mature companies like Nvidia. But there are critical risks that could derail this story as well. Only investors willing to take on extra risk for extra profit should get involved.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

#Forget #Nvidia #Artificial #Intelligence #Stock #Buy #Pied #Fool