Stay informed

Get industry news delivered to your inbox…

Sign up today

Consumer app spending growth is outpacing mobile gaming — and the industry’s top publishers are taking note and divesting into the space.

At EA’s Investor Day this week, there was little mention of its mobile gaming business – despite using the platform to inflate user numbers on its top IPs. But EA has devoted quite a bit of time to mobile – mostly for its new EA Sports app.

The app, which EVP and director of experiences David Tinson notably labeled as its first product beyond gaming, will provide users with the latest sports news, stats and highlights, as well as social features to interact with others . It will also include some “gamified” features such as challenges and mini-games.

But the focus here has clearly been on engaging with a wider non-gaming audience as well as players of its games when they’re not playing titles like EA Sports FC and Madden NFL.

“We see a great opportunity to expand our total addressable market and business beyond gaming,” Tinson said.

It’s in the app

EA isn’t the only game company looking outside of games. Last week, PUBG developer Krafton announced a ₩120 billion ($89.5 million) equity investment in South Korean streaming firm Spoon Labs. The company operates live audio-only streaming and podcast platform Spoon, and launched short-form video streaming service Vigloo. It is the company’s largest investment in a non-gaming company.

Krafton said it was driven to invest by the “growth potential” of the short-form video drama market. You might start thinking about ill-fated platform Quibi, which raised nearly $2 billion for short-form video content and attracted top actors to the service before it crashed and burned within months of launch.

But as Variety reported earlier this year, short dramas are on the rise in China. In fact, citing Nikkei Asia, it is said that the most successful productions will earn tens of millions of dollars within just a few days of release.

Meanwhile, Voodoo, best known for its hypercasual and hybridcasual titles, has been busy building its social media portfolio with chat app Wizz and photo-sharing shopping app BeReal. It acquired the latter for an upfront payment of €166 million in June.

Next, Lords Mobile developer IGG (I Got Games) touts its app business – which includes messaging platform Link – as one of the main drivers of revenue growth for the company. The Pokémon Company’s Pokémon Sleep is a unique way to track sleep while adding gameplay elements, grossing more than $119 million in gross revenue ($83.8 million net) to date, according to AppMagic estimates.

Over the years, Unity and Unreal have also expanded their customer bases into other sectors such as the automotive industry as well as film and TV. During its Q1 2024 earnings call, AppLovin CEO Adam Foroughi said one of the ad company’s goals for future growth was expanding the service outside of games.

“There’s nothing that limits our designs to just gaming,” he said. “By expanding into web marketing and e-commerce, we expect our AI models to improve with further diversity of demand.”

It doesn’t always work. Game of War and Mobile Strike developer MZ has ventured into non-gaming with its Satori platform, which the company hopes could be used for applications such as smart cities and the “internet of things”. But it never took off and spun off into its own entity, taking CEO Gabe Leydon with it.

Non-gaming growth

So what do some of the world’s best game publishers see in the non-gaming world?

Well, the elephant in the room is of course Apple’s privacy changes, which have drastically shaken the foundations of the mobile gaming market.

The non-gaming app space is growing faster due to consumer spending on the App Store and Google Play combined, driven by entertainment, social, and utility and productivity. Which incidentally covers the examples above.

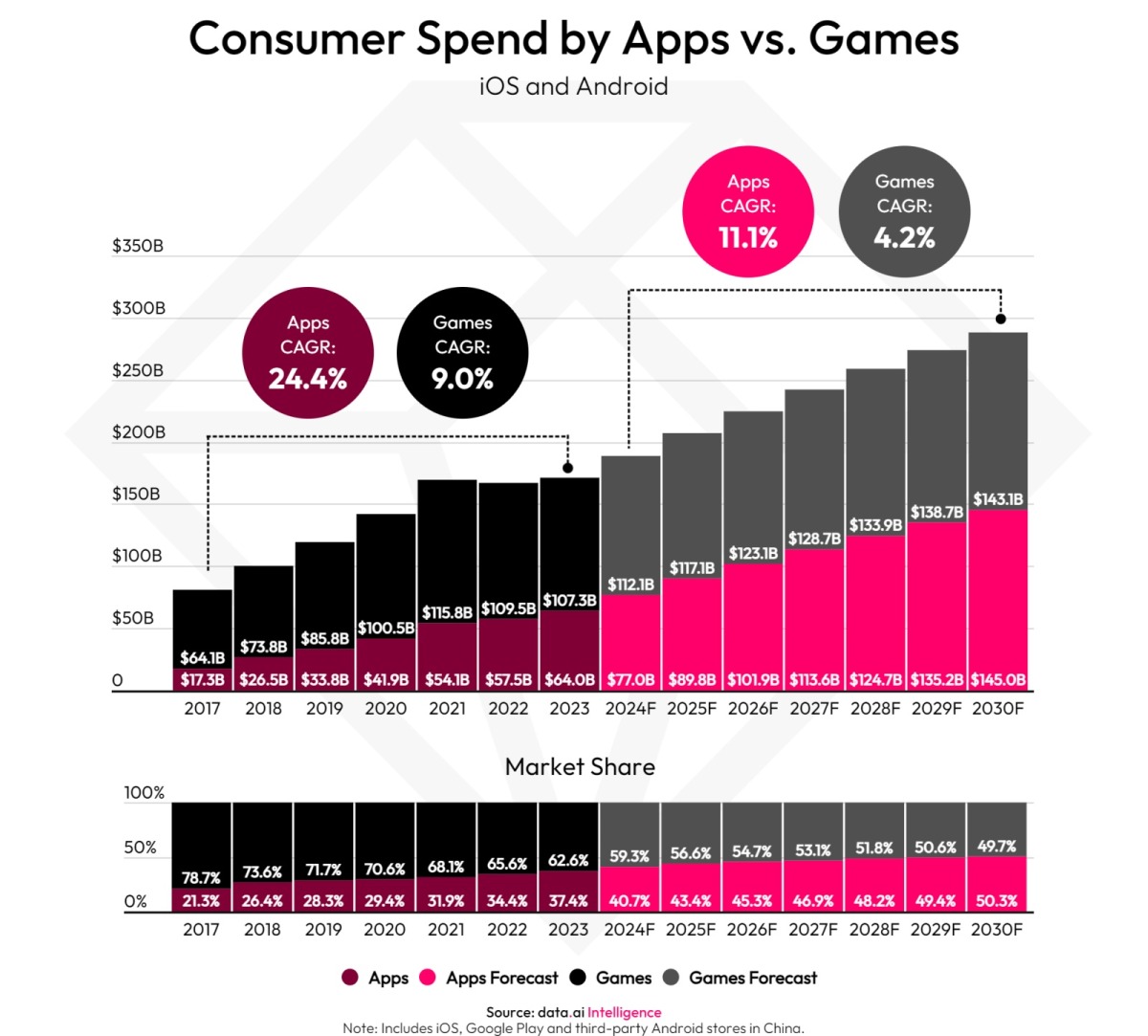

Mobile gaming still wins – $112.1 billion vs. $77 billion, according to Sensor Tower estimates for the end of 2024. But non-gaming apps are expected to grow at a CAGR of 11.1% through 2030 , versus 4.2% growth in games.

What does this mean? Non-gaming revenue could overtake gaming in 2030, reaching $145 billion, compared to $143.1 billion from gaming poultry. It’s also worth noting that spending on streaming platforms like Netflix happens off-platform, hiding larger amounts of revenue.

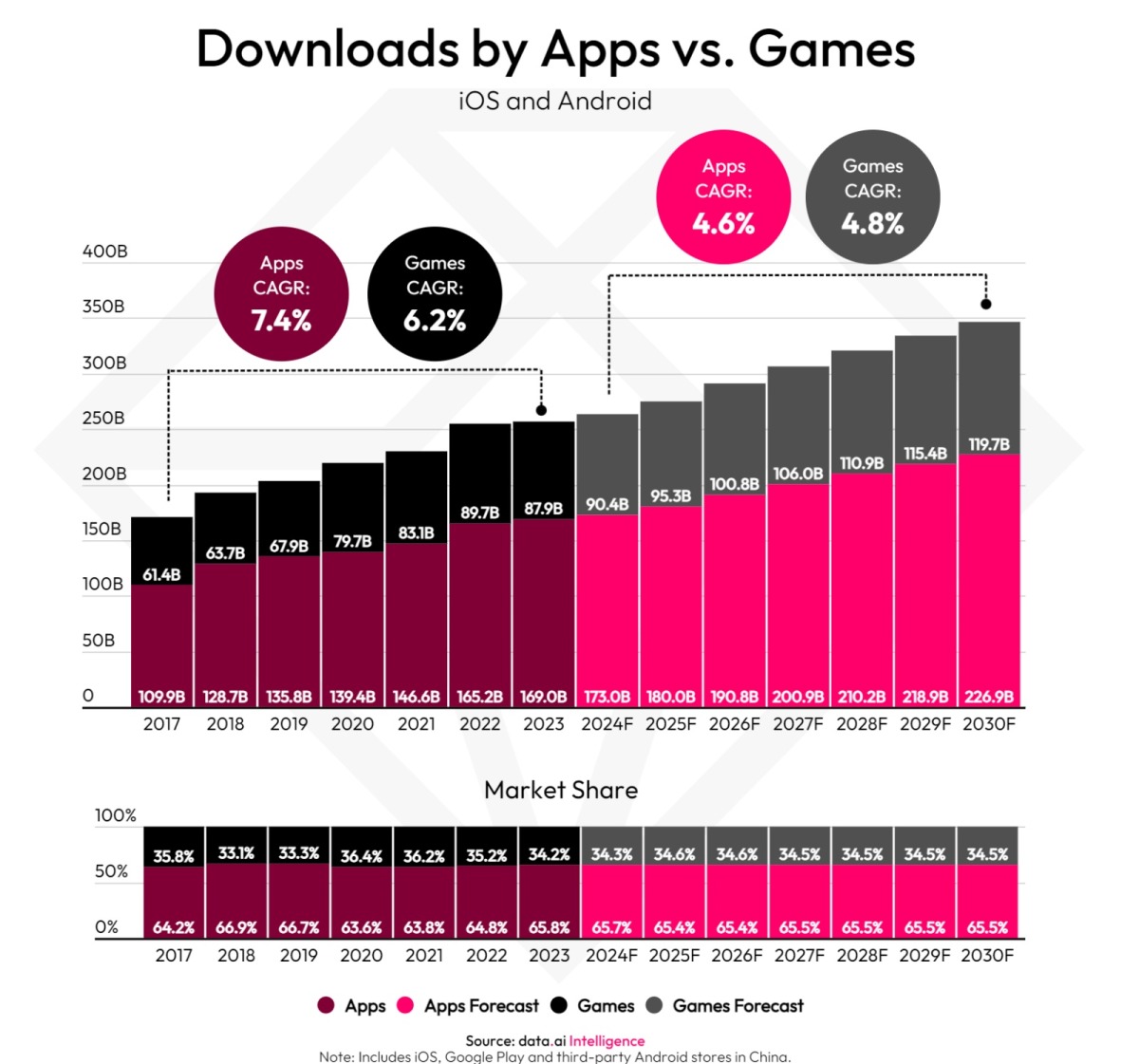

When it comes to downloads, non-gaming already dominates with an estimated 173 billion installs, up to 90.4 billion by 2024. While interesting, apps are expected to grow at a CAGR of 4.6% in while gaming will grow by 4.8%. Still, that’s not much consolation when the end result is potentially 226.9 billion non-game app downloads and 119.7 billion games in 2030.

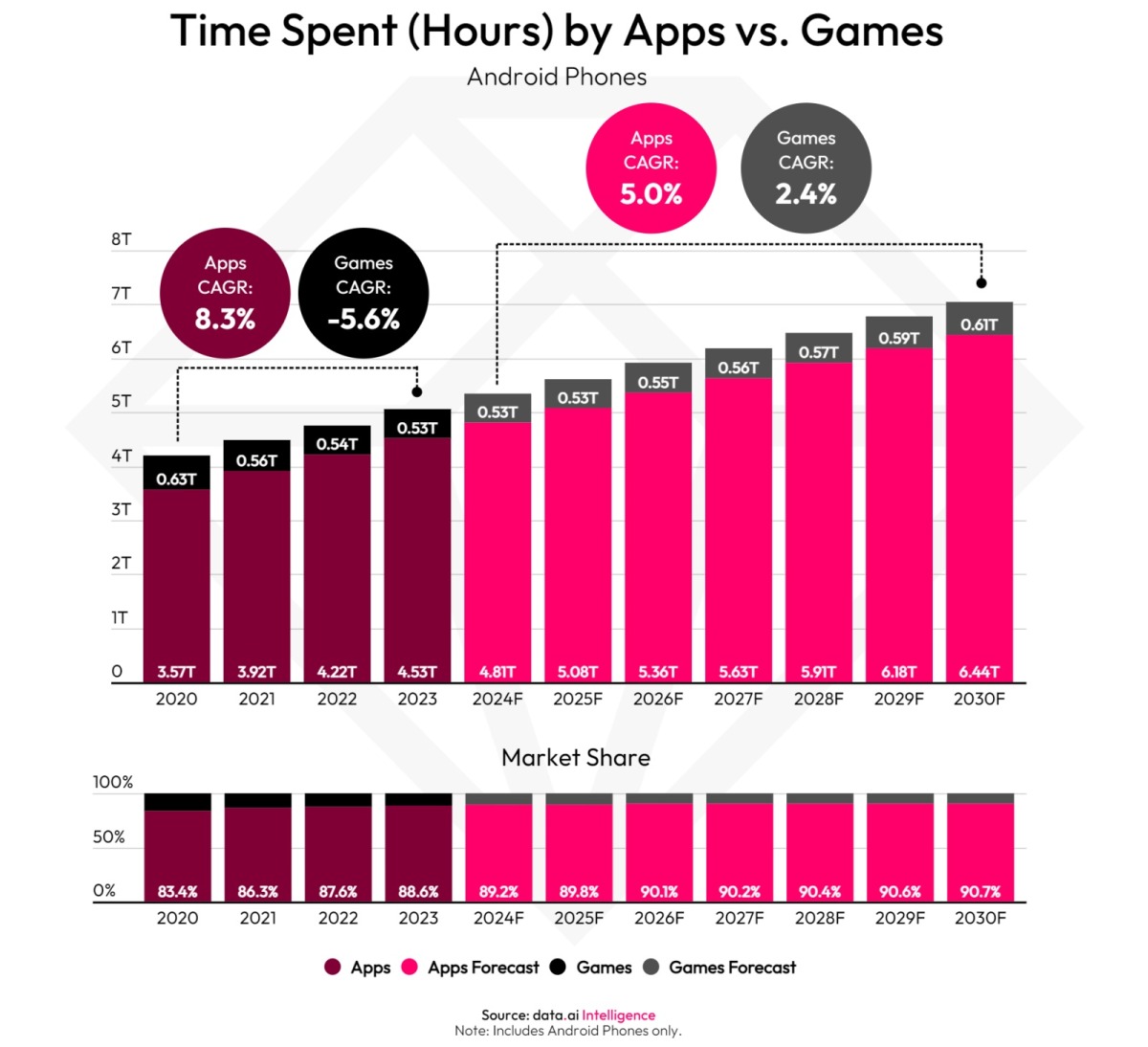

Time spent in apps also far, far exceeds mobile gaming, according to Sensor Tower Android estimates. Android phones saw 0.53 trillion hours played in 2023, compared to 4.53 trillion hours of interaction with non-gaming apps.

Change of industry?

In addition to investing in non-gaming apps and platforms, gaming companies have started to become transmedia giants. Or at least, it’s trying to be as Hollywood looks to hit its top IPs with hits like The Last of Us, Detective Pikachu, Sonic the Hedgehog and The Super Mario Bros. Movies. And then sometimes you get failures like the Borderlands movie, but the intent is there.

With solid technological foundations for running live games and multiplayer services, highly engaged communities, carefully managed “forever franchises” and expertise in user acquisition, perhaps some of the world’s biggest game publishers now consider themselves the biggest social and entertainment companies in the world.

#publishers #leaving #games